Iron & Steel In India

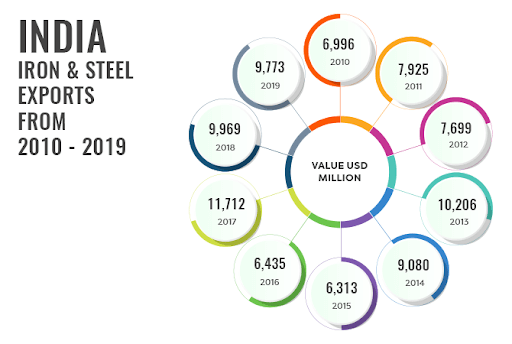

The relevance of iron and steel in the international market has evolved. Today, it has spread to an extent where its consumption and production are a country’s indicators for economic development. For a developing country like India, it has emerged as a hub of iron and steel manufacturing and exports. India’s exports of iron and steel have been steadily increasing over the last two decades.

Iron ore, alongside industrialization and the growth of the economy, has pushed India’s rank as one of the leading global exporters of iron and steel. Today, the country is among the key metal processing and manufacturing players. Statistics suggest that India exported 14.62 million metric tons of iron and steel in 2015 and peaked at 17.96 million in 2017. Over the last two decades, iron and steel production has increased by 75%, indicating a steep organic increase in demand for steel products.

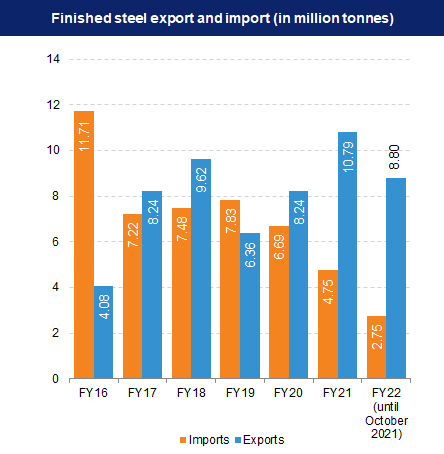

Trade Value Of Iron & Steel From FY 2016-22

However, a global disruption in the supply chain dynamics since the COVID pandemic has resulted in fluctuating exports of iron and steel in the country. In 2019, India exported 8.49 million metric tons of iron and steel, which decreased to 7.64 million in 2020.

Moreover, with finished steel consumption expected to reach the 230 MT threshold by 2030-31, India’s iron and steel market’s future is mostly bullish.

Market Opportunities

The iron and steel industry is an accommodating sector that continues to provide significant returns to industry participants. The budding growth of the industry has drawn investment from other sectors as well.

In April 2022, India’s completed steel consumption was 9.072 MT. Between April and July 2022, finished and crude steel output was 38.55 and 40.95 MT, respectively.

Statistics show India’s steel consumption stood at 75.34 MT in April-December 2022. The crude and finished steel outputs between April and July of the same year were 40.95 MT and 38.55 MT, respectively.

Finished steel exports stood at 5.33 MT in FY23 (until January 2023), while imports were around 5 MT.

The ongoing consolidation has also opened a gateway for global players to enter the Indian market. The government issued guidelines for the Production-Linked Incentive (PLI) scheme to push the sector’s growth in October 2021. The Ministry of Steel was allocated Rs. 47 crore (US$ 6.2 million) in the Union Budget 2022-23.

Future Of Iron & Steel Sector In The Country

The projected steel production is expected to increase to 300 million tonnes annually by 2030-2031. By the end of FY 2030-31, crude steel production is expected to reach 255 million tonnes at 85% capacity utilization, while finished steel production can reach 230 million tonnes, assuming a 10% yield loss or a 90% conversion ratio for raw steel to finished steel.

Since the industry accounts for up to 2% of India’s GDP, the government has also pushed several schemes to flourish the sector. With several schemes in place, the government has a fixed objective of doubling the rural consumption of steel from 19.6 to 38 kg/per capita by 2030-31.

India’s low per capita income from steel and huge scope for growth will be the key indicators to push the sector in the coming years.